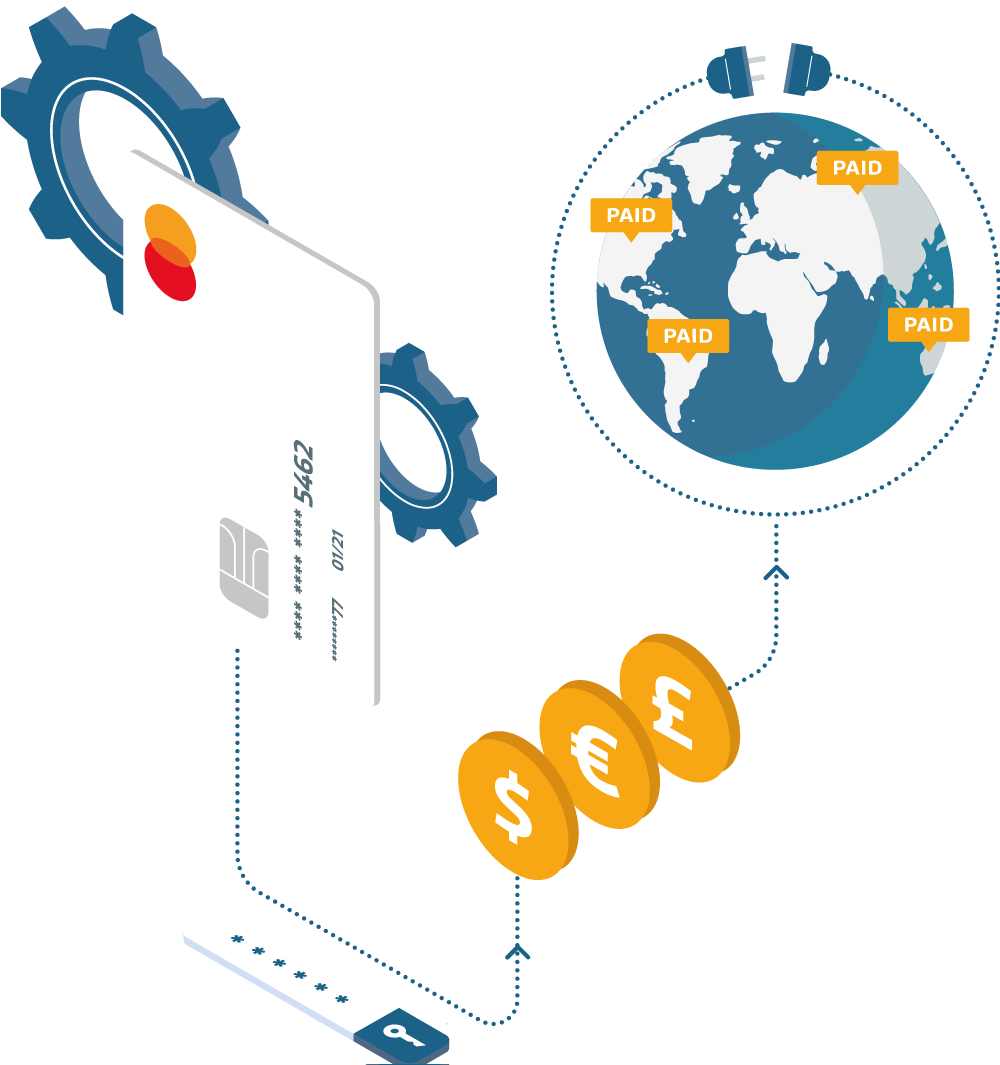

Boost subscriber acquisition, optimise transaction success, and reach global audiences with a range of payment options.

For over 20 years, eSuite has powered payments and billing for enterprise media companies across the globe, enabling them to deploy secure and optimised payment journeys to maximise subscription revenues. Media companies can benefit from a wide range of traditional, alternative and localised payment methods to increase conversion rates and expand into other markets.

Speak To An ExpertPayment Channels

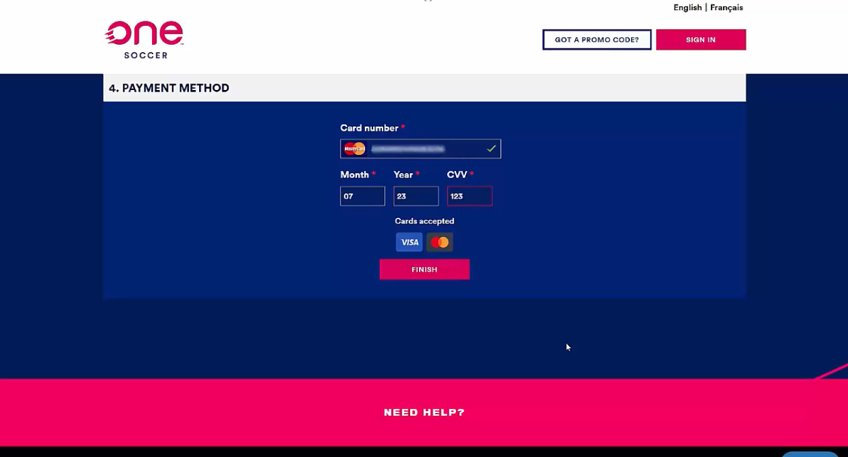

Accept B2C or B2B payments for your digital and physical products across all major channels

Security & Compliance

Protect data with the highest security standards and drastically reduce compliance obligations & costs

Payment Services

Enhance your payments with a range of complementary services

Payment Optimisation

Boost transaction approval rates by more than 50% and reduce involuntary churn, ensuring acquisition efforts are not wasted and recurring revenues maximised.

eSuite’s Retention & Recovery module offers a range of tools to prevent payment breakages such as outdated payment details, insufficient funds or generic declines, reducing involuntary churn bu more than 90%. This specialist functionality enables media companies to optimise payments and boost payment success rates through features such as retry rules, payment optimisation windows, card updater services and predictive churn algorithms.

Payment Routing

Take advantage of commercial and operational benefits by routing transactions intelligently when offering a wide range of currencies or operating multiple business entities.

Payment routing enables media companies to route and distribute transactions across a portfolio of merchant accounts. This could be to minimise transaction costs, increase card authorisation rates, avoid currency conversion fees, reduce failures for suspected fraud or optimise internal accounting practices. Additionally, by distributing transactions down alternative routes, this also acts as an automated fail-over in unlikely events.

Fraud Protection

Protect your business from fraudulent users attempting to validate stolen cards and resulting transaction fees of tens of thousands.

eSuite Shield provides a ‘first point of contact’ protection layer to strengthen the validation of registering new customers and limit the number of card wallets and accounts which can be created, typically by automated scripts. This drastically reduces the fees incurred and minimises the risk of reputational damage.

Payment Connectors

Save time by rapidly connecting global alternative payment methods with eSuite’s Subscription & Billing platform.

With a growing consumer requirement to support a range of alternative payment methods (APMs), eSuite has integrated the widest range of APMs on the market. However, for very specific APMs, eSuite’s rapid payment integration framework, eSuite Connect, enables MPP Global or external parties to quickly build, host and deploy most alternative payment methods.

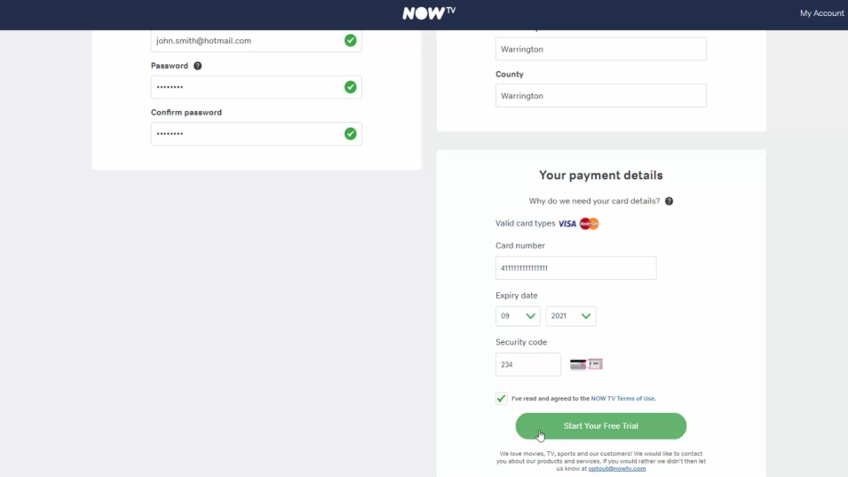

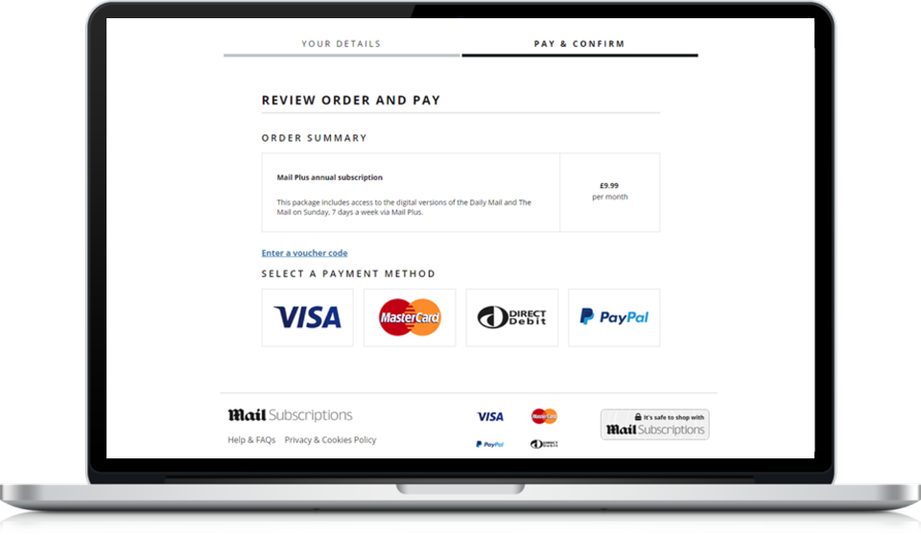

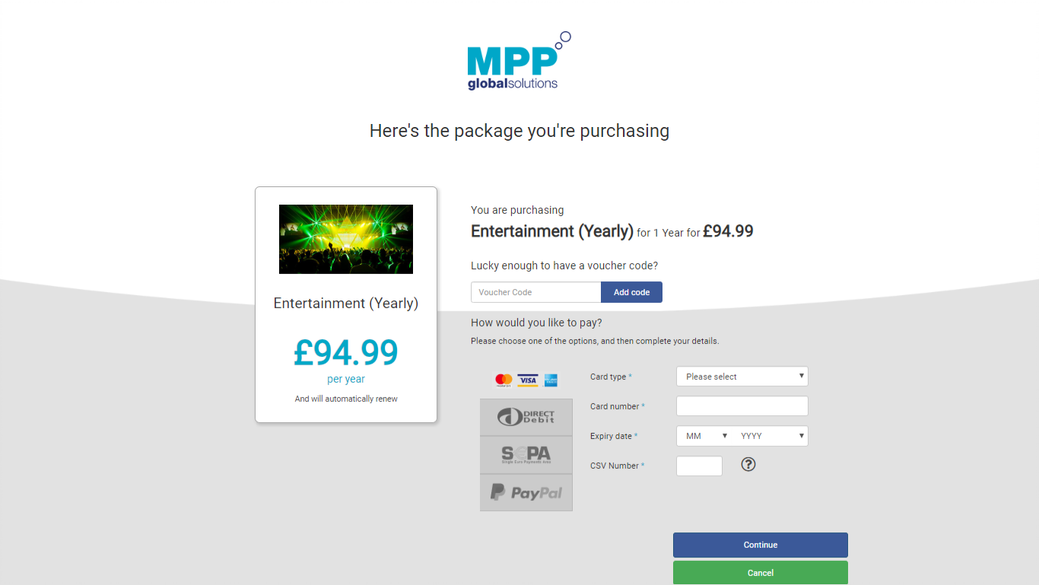

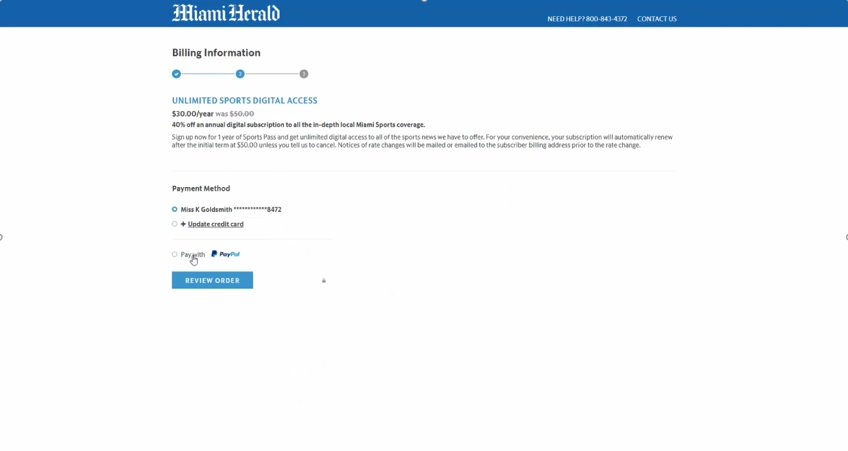

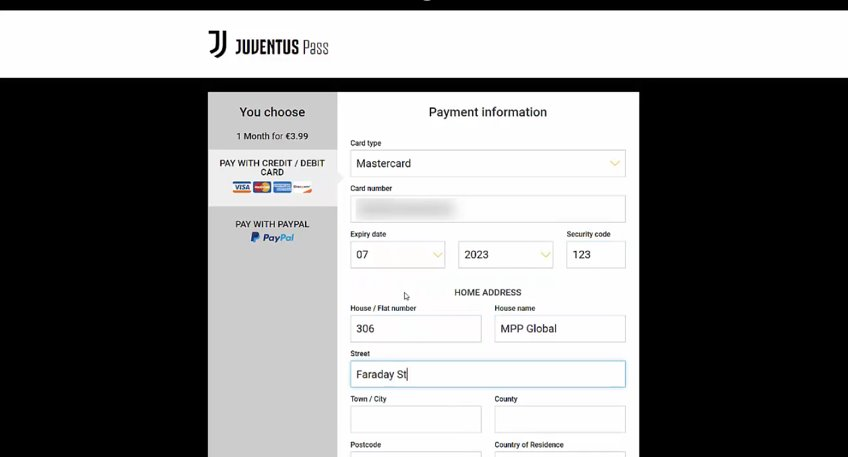

Payments in Action

See our payment solutions in live action on our client websites and apps

en

en